The value of EU Geographical Indication (GI) food and drink products

On 4 March 2013 the European Commission published the results of a study undertaken on the value of Geographical Indication (GI) food products. The results provide some insight into the overall impact of GI products which are considered here from the perspective of the UK.

A GI is the name of a product where a given quality, reputation or other characteristic of the product is essentially attributable to its geographical origin. It is a type of intellectual property right that can apply in the EU to different types of products under one of four schemes:

- Wine under Regulation (EC) 1234/2007.

- Spirits under Regulation (EC) 110/2008.

- Agricultural products and foodstuffs under Regulation (EU) 1151/2012.

- Aromatized wine products under Regulation (EEC) 1601/91.

A Protected Designation of Origin (PDO) product is one produced, processed and prepared in a defined geographical area using recognised know-how. Products owe their characteristics exclusively or essentially to their place of production and the know-how of local producers.

A Protected Geographical Indication (PGI) product is one whose reputation or characteristics are closely linked to production in the geographical area. Agricultural products and foodstuffs must have at least one of the stages of production, processing or preparation which takes place in the area. Wines must use at least 85% of the grapes from the area.

The European Commission believes GIs offer the following benefits:

- Quality assurance for consumers that they are buying a genuine product with specific qualities.

- All producers complying with the product specification can benefit, it is not a right owned by an individual or defined group of producers.

- Since only producers complying with the product specification may use the name competition in the market is fair.

- The name is protected by the Member States control authorities.

- A price premium is obtained, on average GI products are sold at a price 2.23 times higher than comparable non-GI products, although in the UK the premium is 1.86 times higher.

- GI producers may benefit from EU funds for the promotion of quality products.

- Products are linked to rural areas, which derive associated benefits.

- GI products help to reconnect consumers and producers, protect local traditions and carry environmental benefits, linking traditional products with landscapes and farming systems.

The study centred on the 2,768 protected names registered on 1 January 2010. The current registers are the E-Bacchus Register for wines, DOOR Database for agricultural products and foodstuffs and E-Spirit-Drinks Database for spirits.

Total sales in 2010 were over €54bn, which is 5.7% of the total value of the food and drink sector across the EU of €956bn. Wine accounts for over a half, 56% of the total sales value of GI products, followed by agricultural products and foodstuffs (29%) and spirits (15%). Aromatised wines account for just 0.1% of sales by value.

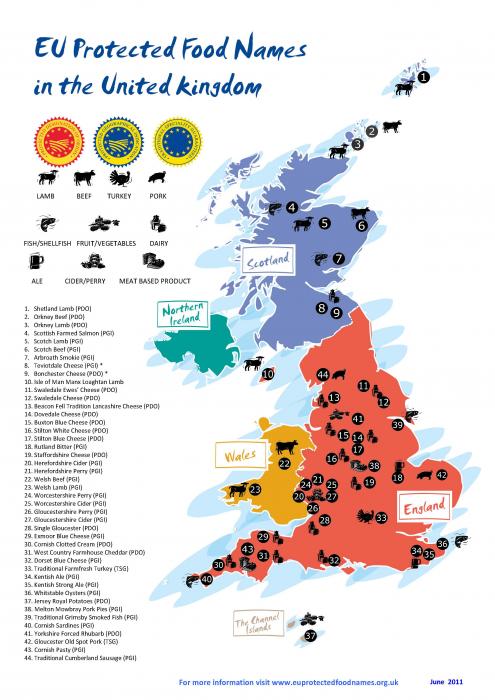

The UK had only 1.4% (39) of the total number of GI products but these accounted for 10% of total sales value which placed it in fourth place behind France (38%), Italy (22%) and Germany (11%). The main sectors contributing to sales value in the UK were spirits (81%) and fresh meat (9%) with the higher price premiums being achieved for beers, wine and spirits. Sales of GI products were in total worth €5.5bn (£4.7bn) out of a total £76bn, around 6.2%, in 2010.

Amongst UK agricultural products and foodstuffs, the main categories were fresh meat, seafood, vegetables and cheese. In the period 2005-10 sales decreased in all these categories except fresh meat which by volume grew 33% but in value was up 55%. Cheese production fluctuated reaching a high in 2007 and a low in 2009. The UK was the leading EU producer of GI lamb and beef, 71% and 57% respectively of total EU sales by value.

The premiums indicated are a value premium which does not take into account any additional costs incurred by producers of GI products such as the cost of compliance with a scheme. The actual premium achieved is the subject of a further study currently being carried out to determine the added value for GI producers which should be available early next year.

Full details about the value premium study can be found here.